Additional Child Tax Credit Worksheet Tax Credit History and Updates The Child Tax Credit was established in 1997 to assist families with offsetting the general cost of raising children Additional Child Tax Credit Worksheet about child tax creditsIf you answered Yes on line 9 or line 10 of the Child Tax Credit Worksheet in the Form 1040 Form 1040A or Form 1040NR instructions or on line 13 of the Child Tax Credit Worksheet use Parts II IV of Schedule 8812 to see if you can take the additional child tax credit If you have an additional child tax credit on line 13 of Schedule 8812 carry it to Form 1040 line 67 Form

tax credit adoption tax credit 2017Claiming the Federal Adoption Tax Credit for 2017 Updated March 2017 For more about the adoption tax credit see our main page on the subject and our FAQS If you finalized your adoption in a year other than 2017 please use the links in the menu to go to the page of the year that you adopted Additional Child Tax Credit Worksheet freeform14CHILD REN 6 ADDITIONAL CHILD REARING COSTS OF PARENTS 6a Child Care Costs of Parent Receiving Support 1 Reasonable work related child care costs of parent receiving support 2 Child Care Tax Credit See Form 14 Directions 6a TOTAL adjusted Child fileyourtaxesnow 2017 earned income tax credit eitcWho can claim 2017 Earned Income Tax Credit EIC When filing taxes for 2017 due in April 2018 working families with children that have annual incomes below about 39 000 to 53 300 depending on marital status and the number of dependent children may be eligible for the federal EITC

pdf f8812 pdfForm 8812 Department of the Treasury Internal Revenue Service 99 Additional Child Tax Credit Complete and attach to Form 1040 Form 1040A or Form 1040NR Additional Child Tax Credit Worksheet fileyourtaxesnow 2017 earned income tax credit eitcWho can claim 2017 Earned Income Tax Credit EIC When filing taxes for 2017 due in April 2018 working families with children that have annual incomes below about 39 000 to 53 300 depending on marital status and the number of dependent children may be eligible for the federal EITC details learn about no tax status and No Tax Status and Limited Income Credit can reduce the amount of personal income tax you pay Based on your Massachusetts Adjusted Gross Income AGI you may qualify for either one

Additional Child Tax Credit Worksheet Gallery

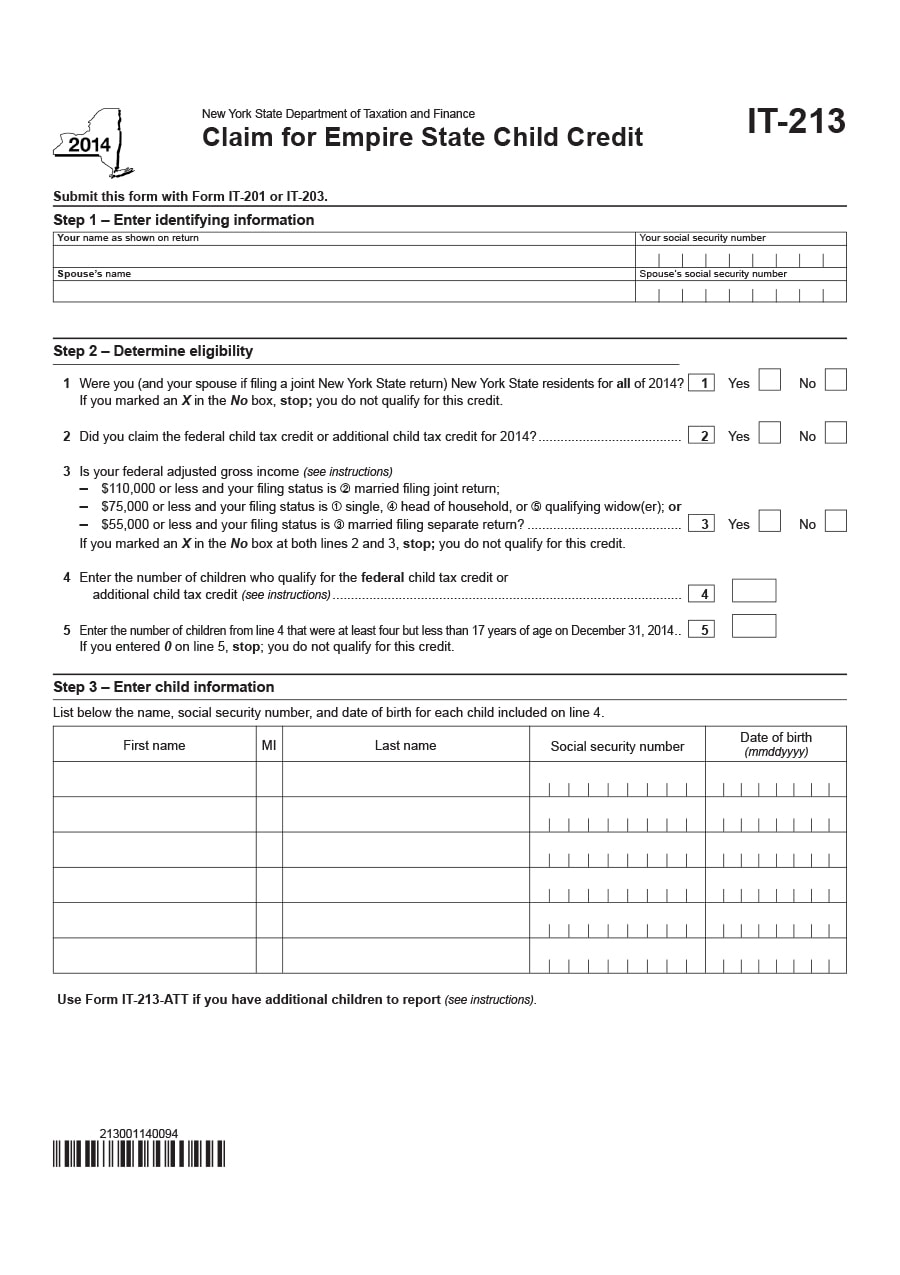

child tax credit worksheet 20, image source: breadandhearth.com

gfiYh6od, image source: lbartman.com

chart book the earned income tax credit and child additional worksheet 16tax 840x761, image source: brokeasshome.com

federal tax forms filing sample 1040nr form 2013 pdf 8 vawebs, image source: www.mrdrumband.com

10311g99, image source: releaseboard.com

form 2441 preschool worksheets credit limit worksheet pureluckrestaurant free tax2011irs_f8863_20120105_p and fsa earned income provider amount paid 1 example instructions 2015 irs 610x789, image source: amitofocc.com

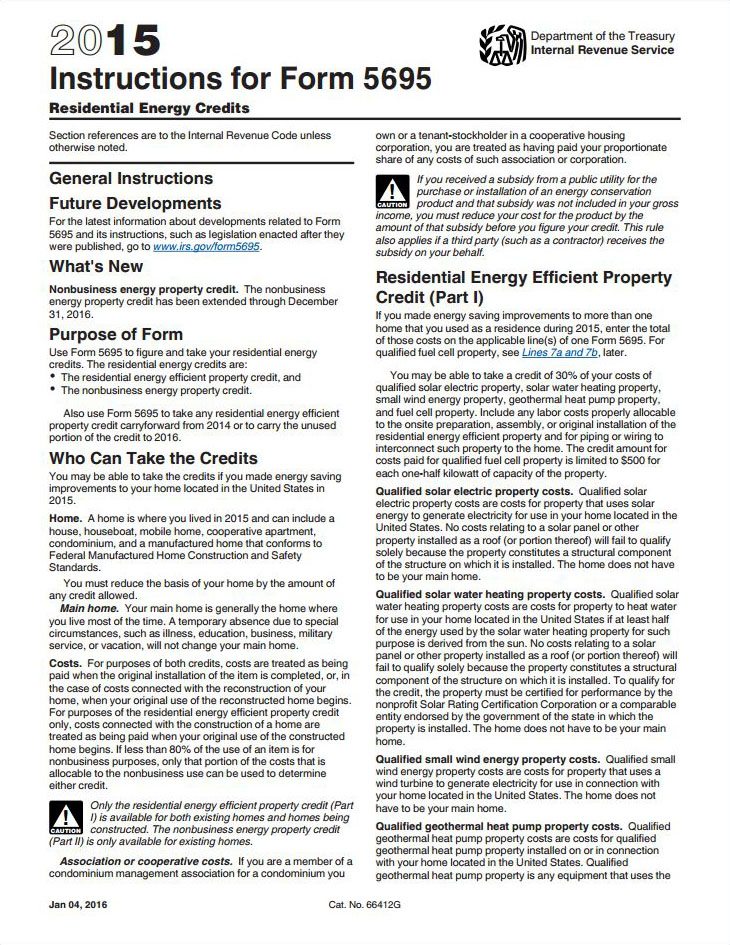

Insulation Tax Credit Instructions for IRS Form 5695, image source: worksheets.symbolics-dk.com

Tax2011IRS_f8812_20111031_Page_1, image source: formupack.com

teaserbox_17967242, image source: brokeasshome.com

2015 federal tax form aquaterra 8863 instructions 2014 taxrms return printable 1040e irs 2016 2017 credit limit worksheet line 27 education credits for, image source: nayvii.com

5 24 16tax f1, image source: brokeasshome.com

best of credit limit worksheet elegant how to fill out irs form 1040 with form wikihow ideas of credit limit worksheet, image source: worksheets.symbolics-dk.com

iowa child support worksheet form 1, image source: www.favforms.com

page_10, image source: waytoohuman.com

2012, image source: comprar-en-internet.net

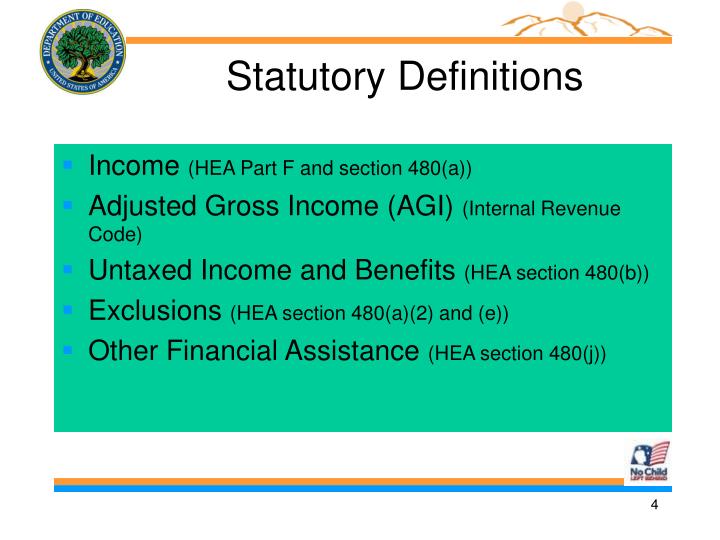

statutory definitions n, image source: www.slideserve.com

300px Total_health_expenditure_per_capita,_US_Dollars_PPP, image source: www.yadongbrake.com

0 comments:

Post a Comment